| Data | Frequency |

|---|---|

| Annual | 1 |

| Quarterly | 4 |

| Monthly | 12 |

| Weekly | 52 |

2 Introduction to Time Series Analysis

2.1 Time series

A time series is a sequence of observations recorded in time order. The time intervals between observations can be regular (e.g., daily, monthly, yearly) or irregular (e.g., magnitude of a earthquake at a particular location).

2.2 Main Time Series Patterns

Trend

Long-term increase or decrease in the data.

Seasonal

A seasonal pattern exists when a series is influenced by seasonal factors (e.g., the quarter of the year, the month, or day of the week).

Seasonality is always of a fixed and known period.

Cyclic

A cyclic pattern exists when data exhibit rises and falls that are not of fixed period.

The duration of these fluctuations is usually of at least 2 years.

The average length of cycles is longer than the length of a seasonal pattern.

2.3 Frequency of a time series (Seasonal periods)

Number of observations per natural time interval (Usually year, but sometimes a week, a day, an hour)

Single Seasonality

The time series exhibits one repeating pattern at a fixed frequency.

Example:

Monthly sales that peak every December (annual seasonality).

Multiple Seasonality

The time series exhibits more than one repeating pattern at different frequencies simultaneously.

Example:

Hourly electricity demand with a daily pattern (peaks every day at certain hours), a weekly pattern (weekdays vs weekends).

Website traffic with hourly variation and seasonal holiday peaks.

| Data | Minute | Hour | Day | Week | Year |

|---|---|---|---|---|---|

| Daily | NA | NA | NA | 7 | 365.25 |

| Hourly | NA | NA | 24 | 168 | 8766.00 |

| Half-hourly | NA | NA | 48 | 336 | 17532.00 |

| Minutes | 60 | 1440 | 1440 | 10080 | 525960.00 |

| Seconds | 60 | 3600 | 86400 | 604800 | 31557600.00 |

2.4 DataFrame for time series data: Python

When your DataFrame represents a time series, the index is usually the date or time, allowing pandas to:

Plot time series easily

Resample or aggregate data by time

Compute rolling statistics

# Import pandas

#py -m pip install pandas

import pandas as pd

# Define data

value = [100, 250, 78, 300, 500]

time = list(range(2015, 2020))

# Create DataFrame

df = pd.DataFrame({"Year": time, "Observation": value})

# Set 'Year' as index

df.set_index("Year", inplace=True)

# Display the DataFrame

print(df) Observation

Year

2015 100

2016 250

2017 78

2018 300

2019 500For data collected more often than once a year (e.g., monthly, weekly, or daily), it’s important to tell the computer that the index represents time. We do this by converting the index to a time or date type using a time-class function. This helps us sort, select, and analyze the data correctly over time.

# Sample monthly data

data = {

"Month": pd.date_range(start="2025-01-01", periods=6, freq="M"), # 6 months

"Sales": [120, 150, 170, 130, 180, 200]

}

# Create DataFrame

z = pd.DataFrame(data)

# Format Month as "Year Month" (e.g., "2025 Jan")

z["Month"] = z["Month"].dt.strftime("%Y %b")

# Set Month as index

z.set_index("Month", inplace=True)

# Display the DataFrame

print(z) Sales

Month

2025 Jan 120

2025 Feb 150

2025 Mar 170

2025 Apr 130

2025 May 180

2025 Jun 200

2.5 DataFrame for time series data: R

We use tsibbles to store data.

2.6 Dataset: R

# A tibble: 180 × 3

Month Year Earnings

<chr> <chr> <dbl>

1 January 2009 30

2 January 2010 44.7

3 January 2011 72

4 January 2012 88.9

5 January 2013 149.

6 January 2014 233.

7 January 2015 259

8 January 2016 333.

9 January 2017 407.

10 January 2018 448.

# ℹ 170 more rows# A tibble: 180 × 3

Month Year Earnings

<chr> <chr> <dbl>

1 January 2009 30

2 February 2009 26.7

3 March 2009 26.6

4 April 2009 20.3

5 May 2009 19.3

6 June 2009 23.6

7 July 2009 33

8 August 2009 32.2

9 September 2009 29.6

10 October 2009 29.3

# ℹ 170 more rowsy.earnings <- earnings |> mutate(Date = seq(ymd_hm("2009-1-1 0:00"), ymd_hm("2023-12-1 12:00"), by = "month"))

y.earnings# A tibble: 180 × 4

Month Year Earnings Date

<chr> <chr> <dbl> <dttm>

1 January 2009 30 2009-01-01 00:00:00

2 February 2009 26.7 2009-02-01 00:00:00

3 March 2009 26.6 2009-03-01 00:00:00

4 April 2009 20.3 2009-04-01 00:00:00

5 May 2009 19.3 2009-05-01 00:00:00

6 June 2009 23.6 2009-06-01 00:00:00

7 July 2009 33 2009-07-01 00:00:00

8 August 2009 32.2 2009-08-01 00:00:00

9 September 2009 29.6 2009-09-01 00:00:00

10 October 2009 29.3 2009-10-01 00:00:00

# ℹ 170 more rows# A tibble: 180 × 3

Earnings Date Time

<dbl> <dttm> <mth>

1 30 2009-01-01 00:00:00 2009 Jan

2 26.7 2009-02-01 00:00:00 2009 Feb

3 26.6 2009-03-01 00:00:00 2009 Mar

4 20.3 2009-04-01 00:00:00 2009 Apr

5 19.3 2009-05-01 00:00:00 2009 May

6 23.6 2009-06-01 00:00:00 2009 Jun

7 33 2009-07-01 00:00:00 2009 Jul

8 32.2 2009-08-01 00:00:00 2009 Aug

9 29.6 2009-09-01 00:00:00 2009 Sep

10 29.3 2009-10-01 00:00:00 2009 Oct

# ℹ 170 more rowsts.earnings <- y.earnings |>

select(Earnings, Time) |> as_tsibble(index=Time)

ts.earnings# A tsibble: 180 x 2 [1M]

Earnings Time

<dbl> <mth>

1 30 2009 Jan

2 26.7 2009 Feb

3 26.6 2009 Mar

4 20.3 2009 Apr

5 19.3 2009 May

6 23.6 2009 Jun

7 33 2009 Jul

8 32.2 2009 Aug

9 29.6 2009 Sep

10 29.3 2009 Oct

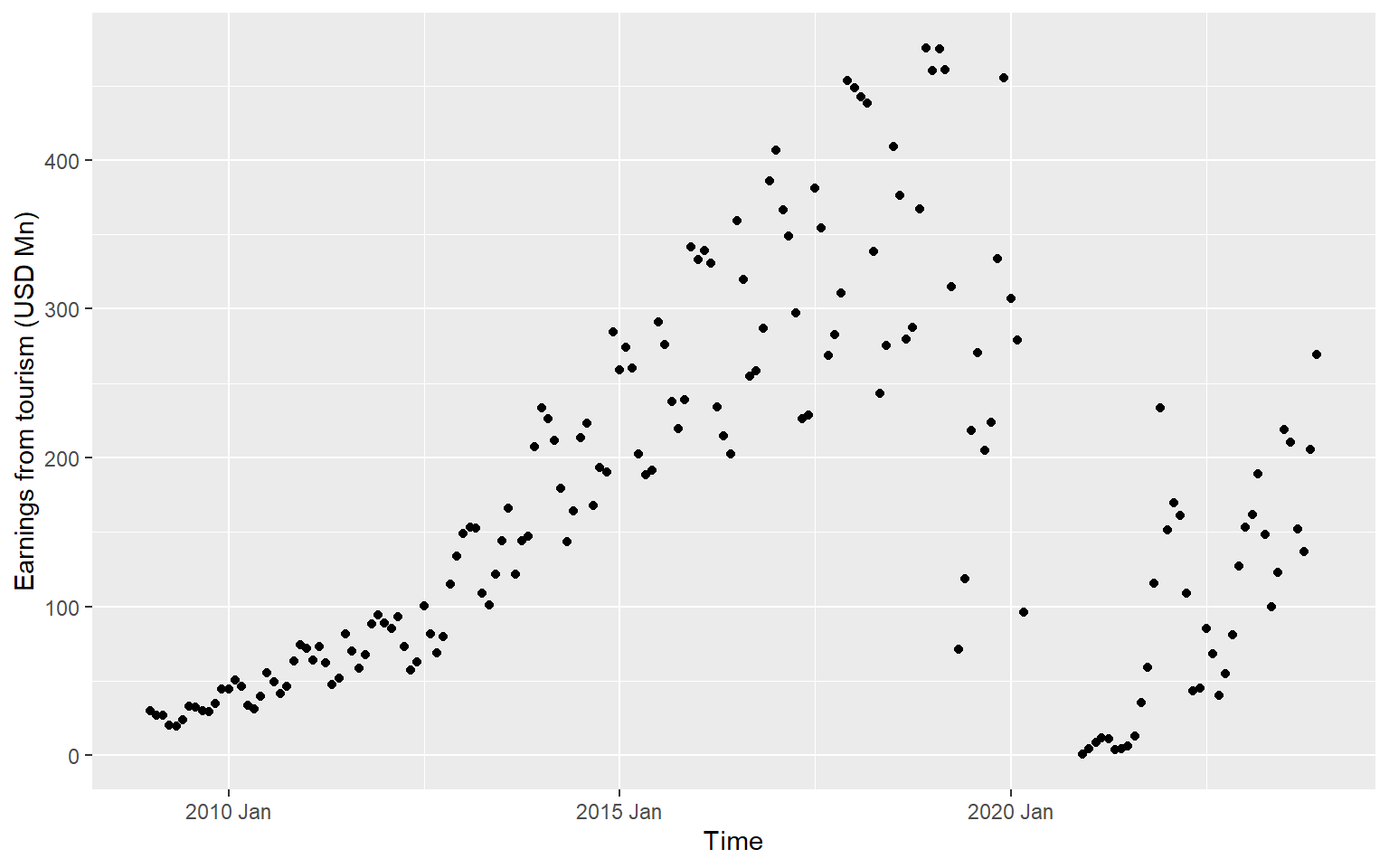

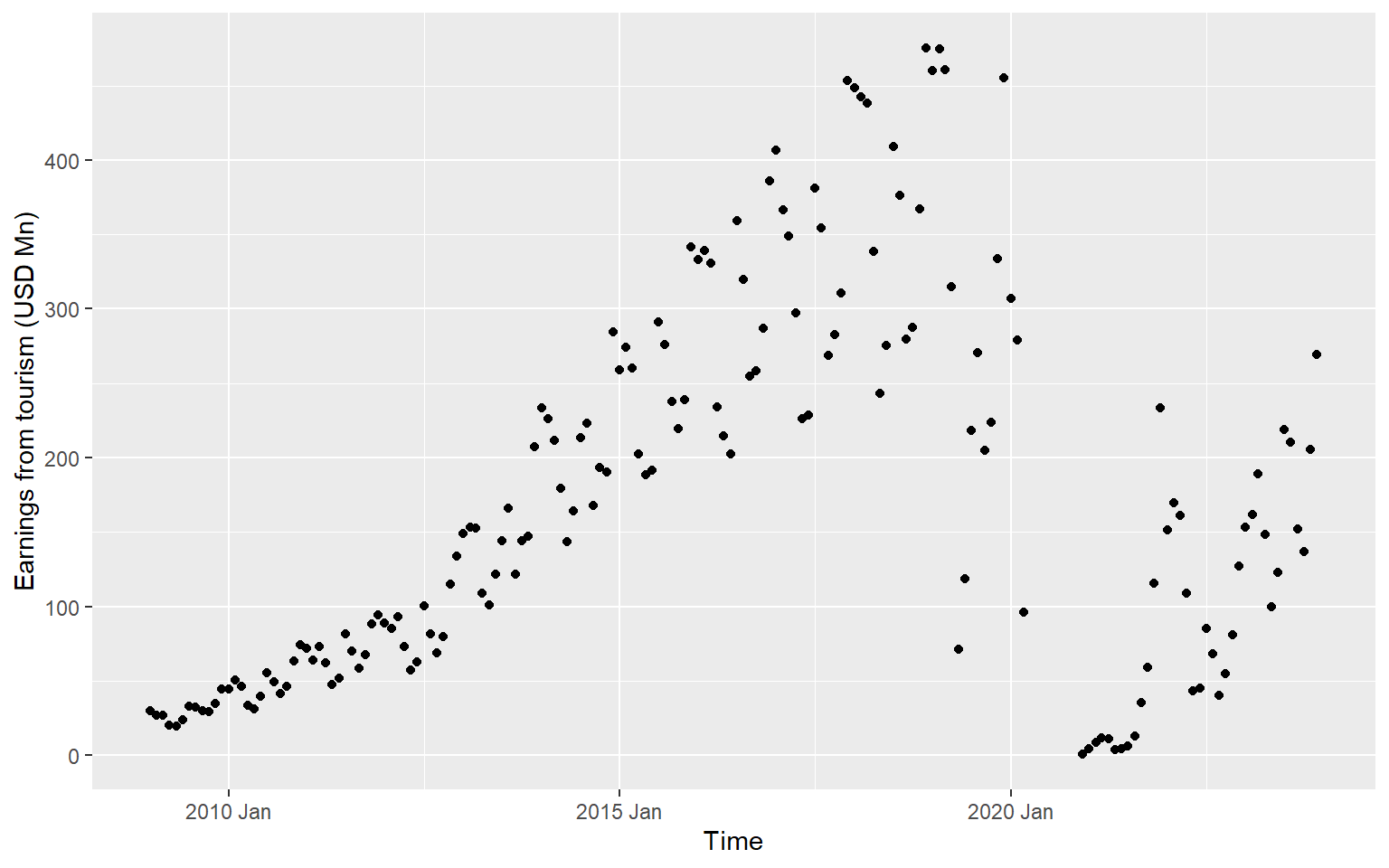

# ℹ 170 more rowsggts <- ts.earnings |>

ggplot(aes(x = Time, y = Earnings)) +

geom_point() +

labs(y = "Earnings from tourism (USD Mn)", x="Time")

ggts

ts.earnings <- y.earnings |>

select(Earnings, Time) |> as_tsibble(index=Time)

ts.earnings# A tsibble: 180 x 2 [1M]

Earnings Time

<dbl> <mth>

1 30 2009 Jan

2 26.7 2009 Feb

3 26.6 2009 Mar

4 20.3 2009 Apr

5 19.3 2009 May

6 23.6 2009 Jun

7 33 2009 Jul

8 32.2 2009 Aug

9 29.6 2009 Sep

10 29.3 2009 Oct

# ℹ 170 more rows2.7 Time series visualisation using grammar of graphics: R

The grammar of graphics is a way of thinking about plots as layers. Each plot is built from components like:

Data – the dataset you are plotting.

Aesthetics (aes) – how variables map to visual properties like x, y, color, or size.

Geometries (geom) – the type of plot (points, lines, bars, etc.).

Facets – split the plot into subplots based on a variable.

Statistics (stat) – summary computations like regression lines or counts.

Scales – control axis limits, colors, or sizes.

Coordinates (coord) – control coordinate system (Cartesian, polar).

Theme – control visual appearance like text, background, and grid.

ggts <- ts.earnings |>

ggplot(aes(x = Time, y = Earnings)) +

geom_point() +

labs(y = "Earnings from tourism (USD Mn)", x="Time")

ggts

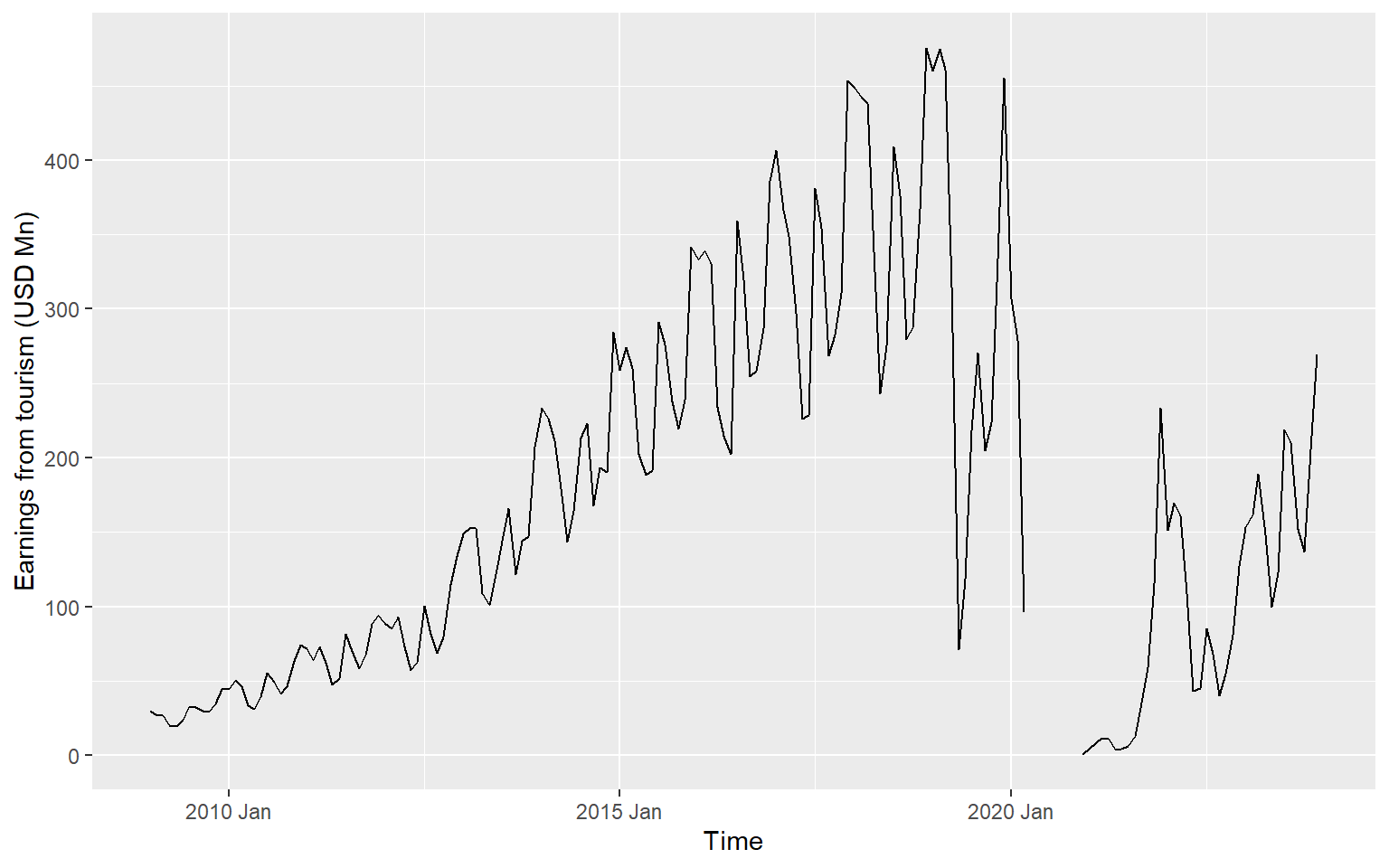

ggts <- ts.earnings |>

ggplot(aes(x = Time, y = Earnings)) +

geom_line() +

labs(y = "Earnings from tourism (USD Mn)", x="Time")

ggts

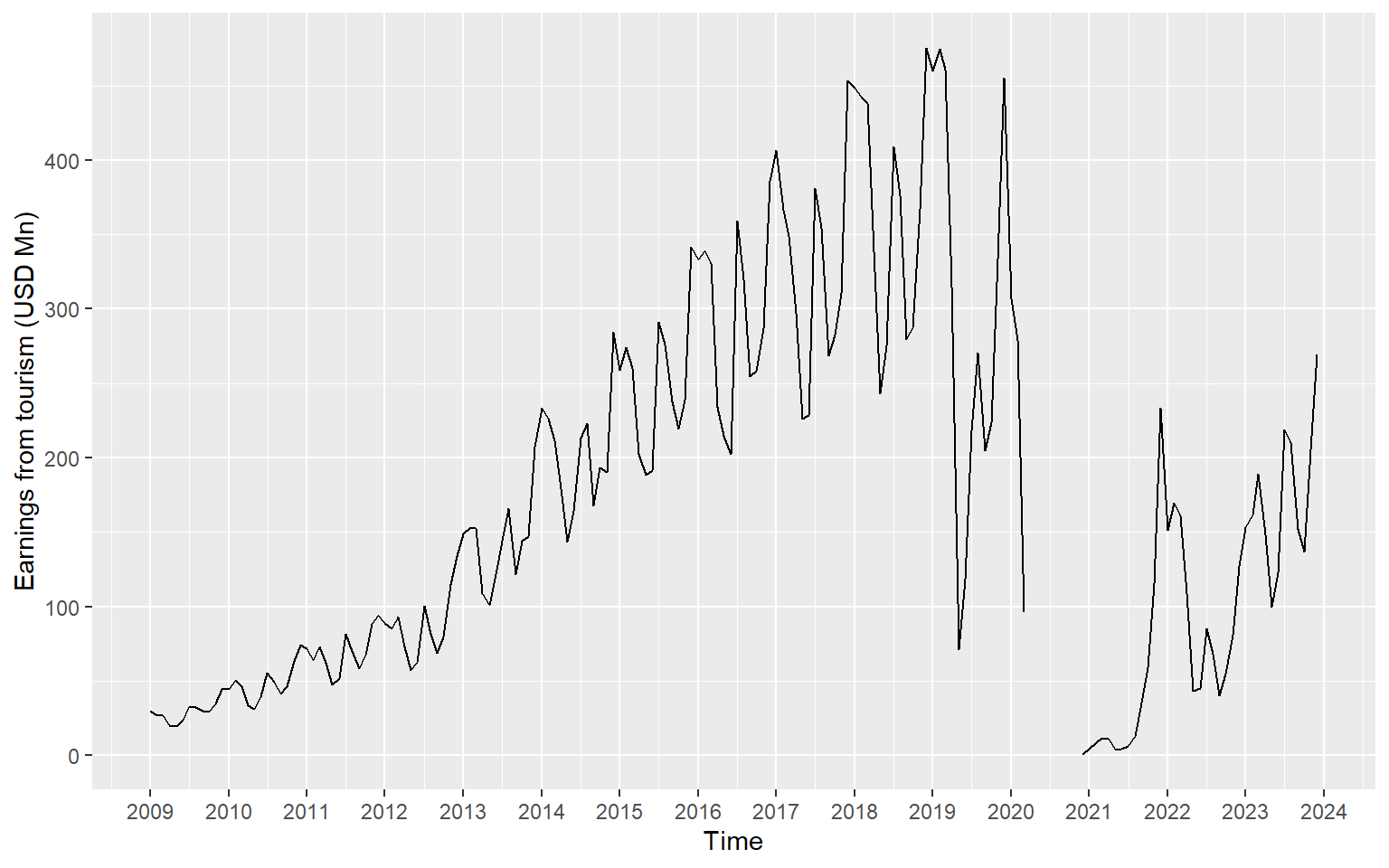

ts.earnings |>

mutate(Time = as_date(yearmonth(Time))) |>

ggplot(aes(x = Time, y = Earnings)) +

geom_line() +

scale_x_date(date_breaks = "1 year", date_labels = "%Y") +

labs(y = "Earnings from tourism (USD Mn)", x="Time")

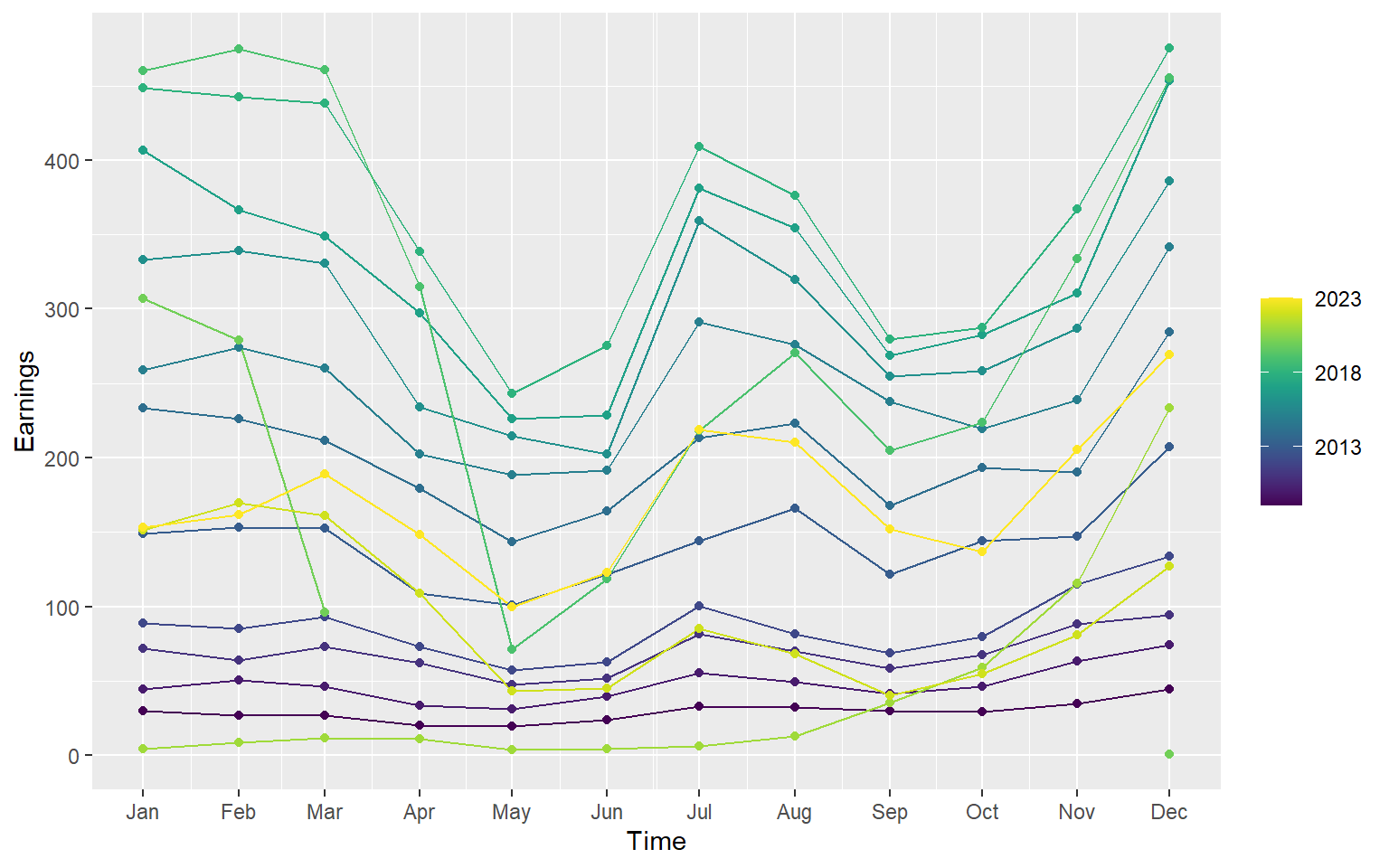

library(viridis)

ts.earnings |>

gg_season(Earnings, period = "1 year", pal = scales::viridis_pal()(15)) + geom_point()

2.8 Dataset: Python

import plotnine as p9

from plotnine.data import economics2.9 Working with Built-in Data Set

import pandas as pd

import plotnine as p9

from plotnine import *

from plotnine.data import *

import numpy as np

economics date pce pop psavert uempmed unemploy

0 1967-07-01 507.4 198712 12.5 4.5 2944

1 1967-08-01 510.5 198911 12.5 4.7 2945

2 1967-09-01 516.3 199113 11.7 4.6 2958

3 1967-10-01 512.9 199311 12.5 4.9 3143

4 1967-11-01 518.1 199498 12.5 4.7 3066

.. ... ... ... ... ... ...

569 2014-12-01 12122.0 320201 5.0 12.6 8688

570 2015-01-01 12080.8 320367 5.5 13.4 8979

571 2015-02-01 12095.9 320534 5.7 13.1 8705

572 2015-03-01 12161.5 320707 5.2 12.2 8575

573 2015-04-01 12158.9 320887 5.6 11.7 8549

[574 rows x 6 columns]economics.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 574 entries, 0 to 573

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 date 574 non-null datetime64[ns]

1 pce 574 non-null float64

2 pop 574 non-null int64

3 psavert 574 non-null float64

4 uempmed 574 non-null float64

5 unemploy 574 non-null int64

dtypes: datetime64[ns](1), float64(3), int64(2)

memory usage: 27.0 KBCreate year and month columns

economics['year'] = economics['date'].dt.year

economics['month'] = economics['date'].dt.month

economics date pce pop psavert uempmed unemploy year month

0 1967-07-01 507.4 198712 12.5 4.5 2944 1967 7

1 1967-08-01 510.5 198911 12.5 4.7 2945 1967 8

2 1967-09-01 516.3 199113 11.7 4.6 2958 1967 9

3 1967-10-01 512.9 199311 12.5 4.9 3143 1967 10

4 1967-11-01 518.1 199498 12.5 4.7 3066 1967 11

.. ... ... ... ... ... ... ... ...

569 2014-12-01 12122.0 320201 5.0 12.6 8688 2014 12

570 2015-01-01 12080.8 320367 5.5 13.4 8979 2015 1

571 2015-02-01 12095.9 320534 5.7 13.1 8705 2015 2

572 2015-03-01 12161.5 320707 5.2 12.2 8575 2015 3

573 2015-04-01 12158.9 320887 5.6 11.7 8549 2015 4

[574 rows x 8 columns]2.10 Time series visualisation using grammar of graphics: Python

[See the tutorial here

](https://thiyangt.github.io/spts_python_practical/Practical1/)

2.11 What is a lag value?

In time series analysis, a lag represents the number of time steps by which a series is shifted backward to compare it with itself.

Lag 1: Compare each value with the previous observation.

Lag 2: Compare each value with the value two steps before.

Lag k: Compare each value with the value k steps earlier.

import pandas as pd

# Small time series with 5 points

data = [10, 12, 13, 15, 14]

dates = pd.date_range(start='2025-01-01', periods=5, freq='D')

df = pd.DataFrame({'Date': dates, 'Value': data})

df.set_index('Date', inplace=True)

# Create lagged series

df['Lag1'] = df['Value'].shift(1) # lag 1

df['Lag2'] = df['Value'].shift(2) # lag 2

# Show the result

print(df) Value Lag1 Lag2

Date

2025-01-01 10 NaN NaN

2025-01-02 12 10.0 NaN

2025-01-03 13 12.0 10.0

2025-01-04 15 13.0 12.0

2025-01-05 14 15.0 13.02.12 Correlation vs Autocorrelation

Correlation

Measures the strength of the linear relationship between two variables

r = \frac{\sum_{i=1}^{n} (x_i -\bar{x})(y_i-\bar{y})}{\sqrt{\sum_{i=1}^{n} (x_i -\bar{x})^2 \sum_{i=1}^{n} (y_i -\bar{y})^2}}

Autocorrelation

Measures the strength of linear relationship between lagged values of time series.

r_k = \frac{\sum (y_t -\bar{y})(y_{t-k}-\bar{y})}{\sum (y_t -\bar{y})^2}

2.13 Your turn: why different values?

# Correlation (autocorrelation) between original series and lagged series

autocorr_lag1 = df['Value'].corr(df['Lag1'])

autocorr_lag2 = df['Value'].corr(df['Lag2'])

print(f"Autocorrelation at lag 1: {autocorr_lag1:.3f}")Autocorrelation at lag 1: 0.744print(f"Autocorrelation at lag 2: {autocorr_lag2:.3f}")Autocorrelation at lag 2: 0.655import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from statsmodels.tsa.stattools import acf

# Small time series with 5 points

data = [10, 12, 13, 15, 14]

dates = pd.date_range(start='2025-01-01', periods=5, freq='D')

df = pd.DataFrame({'Date': dates, 'Value': data})

df.set_index('Date', inplace=True)

print(df) Value

Date

2025-01-01 10

2025-01-02 12

2025-01-03 13

2025-01-04 15

2025-01-05 14# Compute autocorrelation for lags 1 to 4 (max lag = n-1)

autocorr_values = acf(df['Value'], nlags=4, fft=False)

# Show autocorrelation values

for lag, val in enumerate(autocorr_values):

print(f"Lag {lag}: {val:.3f}")Lag 0: 1.000

Lag 1: 0.349

Lag 2: -0.141

Lag 3: -0.481

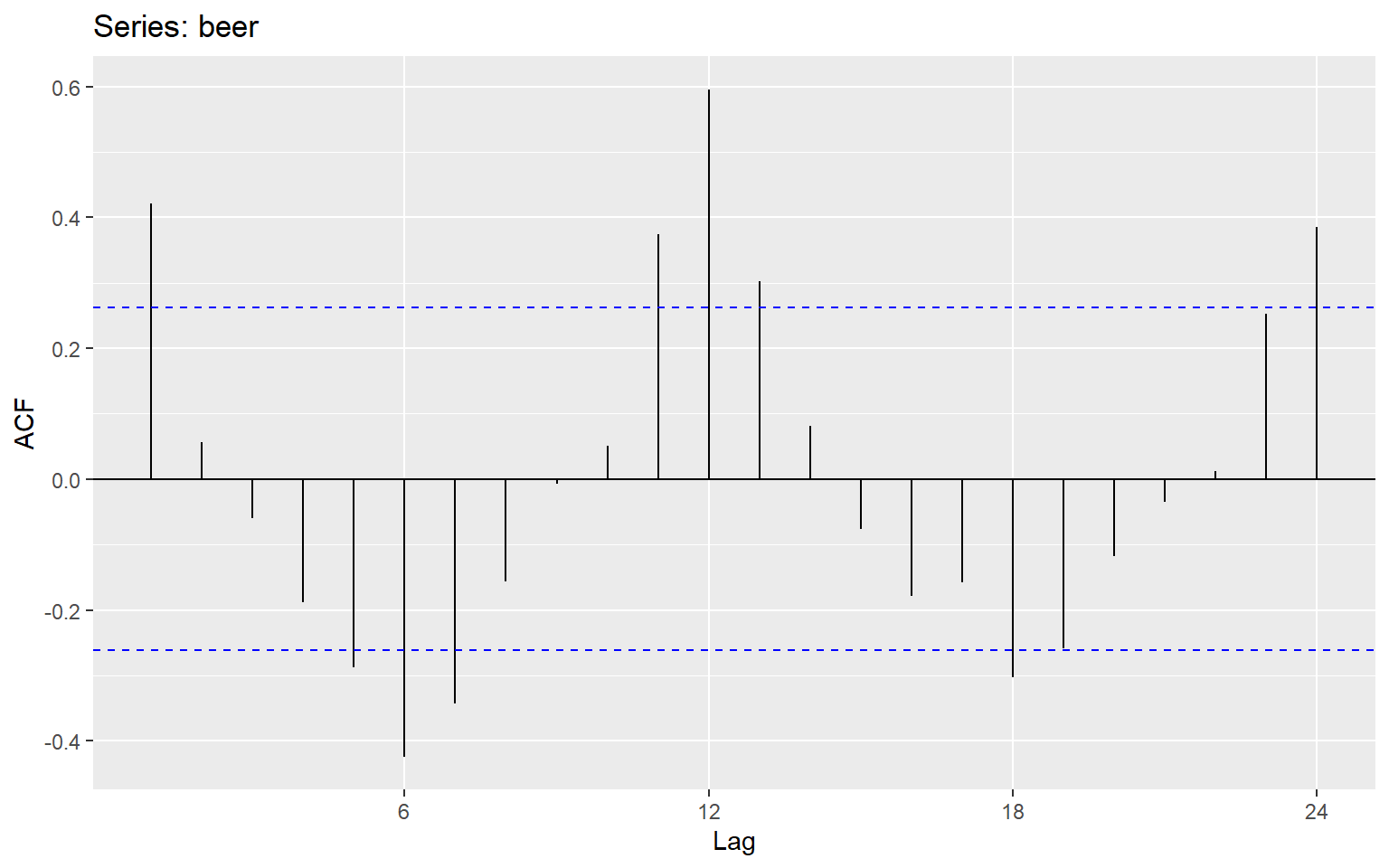

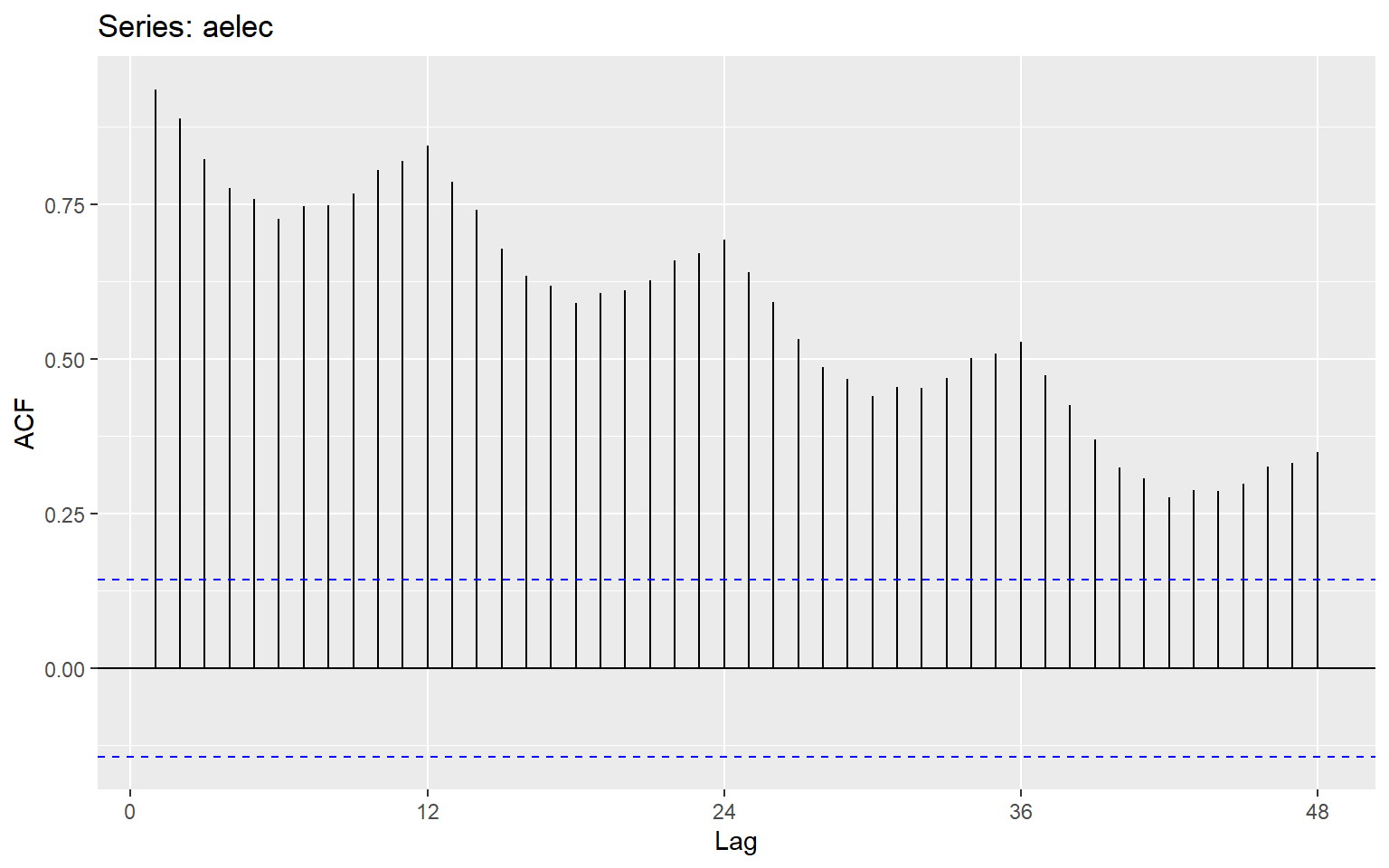

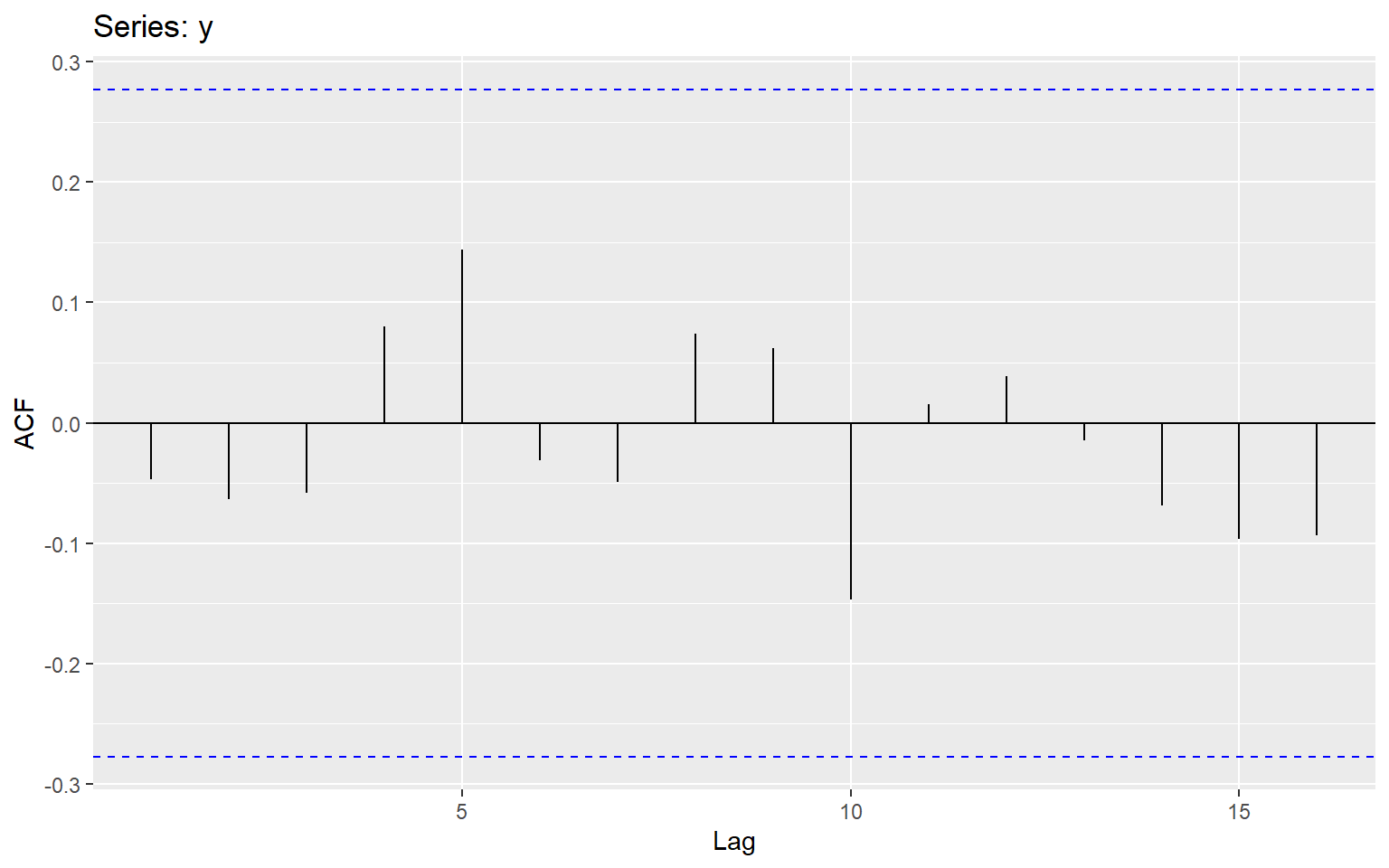

Lag 4: -0.2272.14 Autocorrelation plots (ACF)

The ACF measures the correlation between a time series and lagged versions of itself. It tells us how past values influence current values.

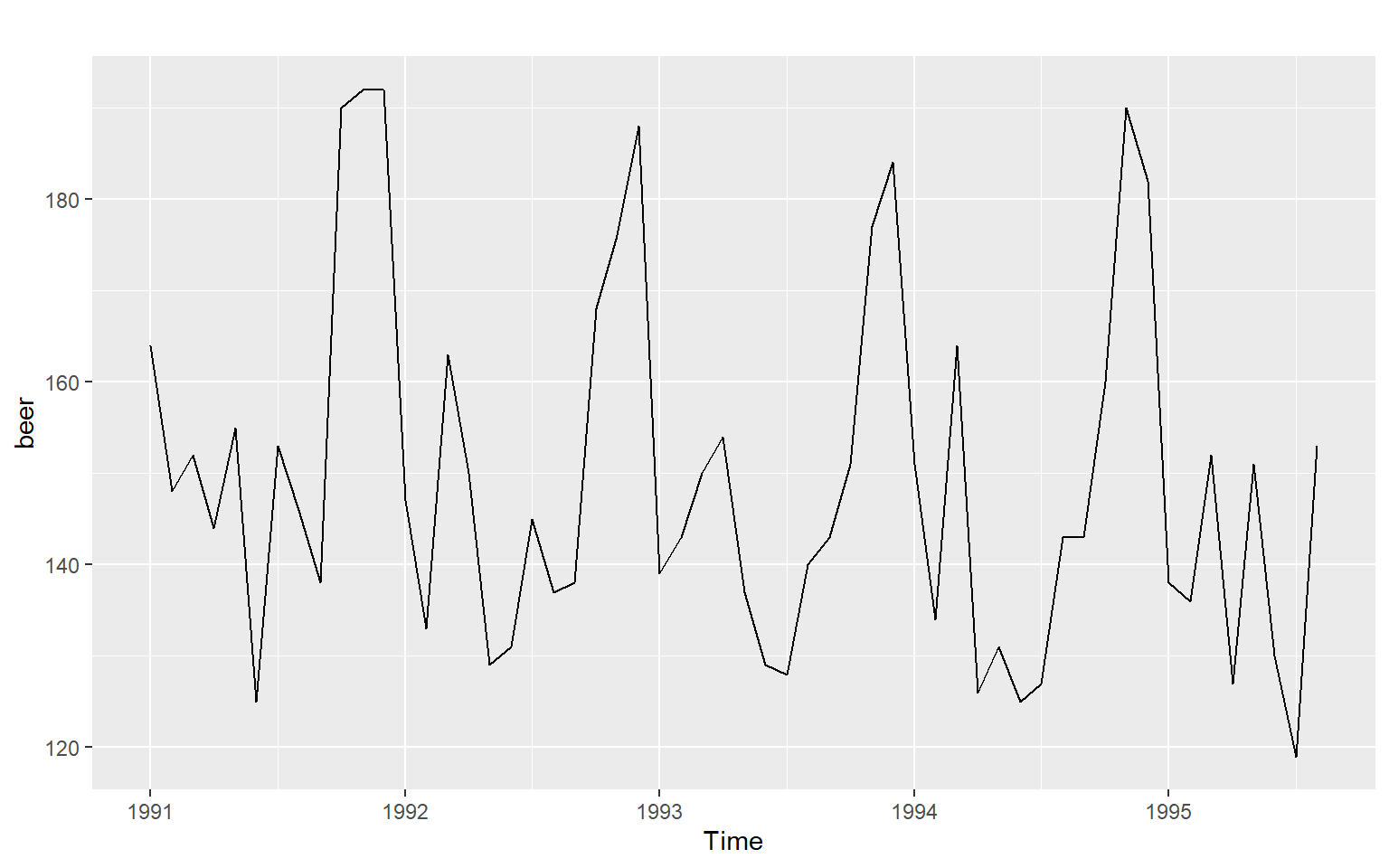

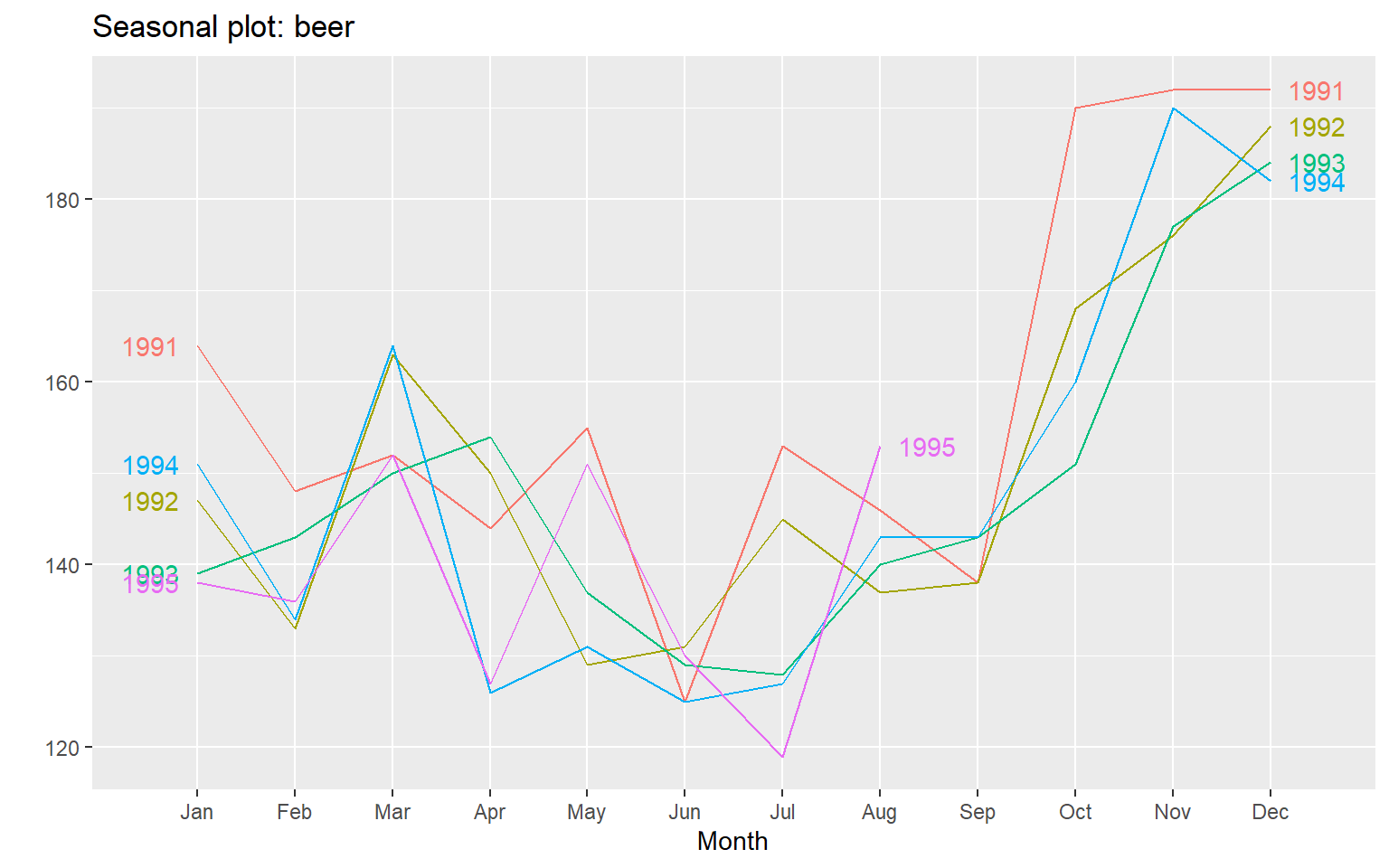

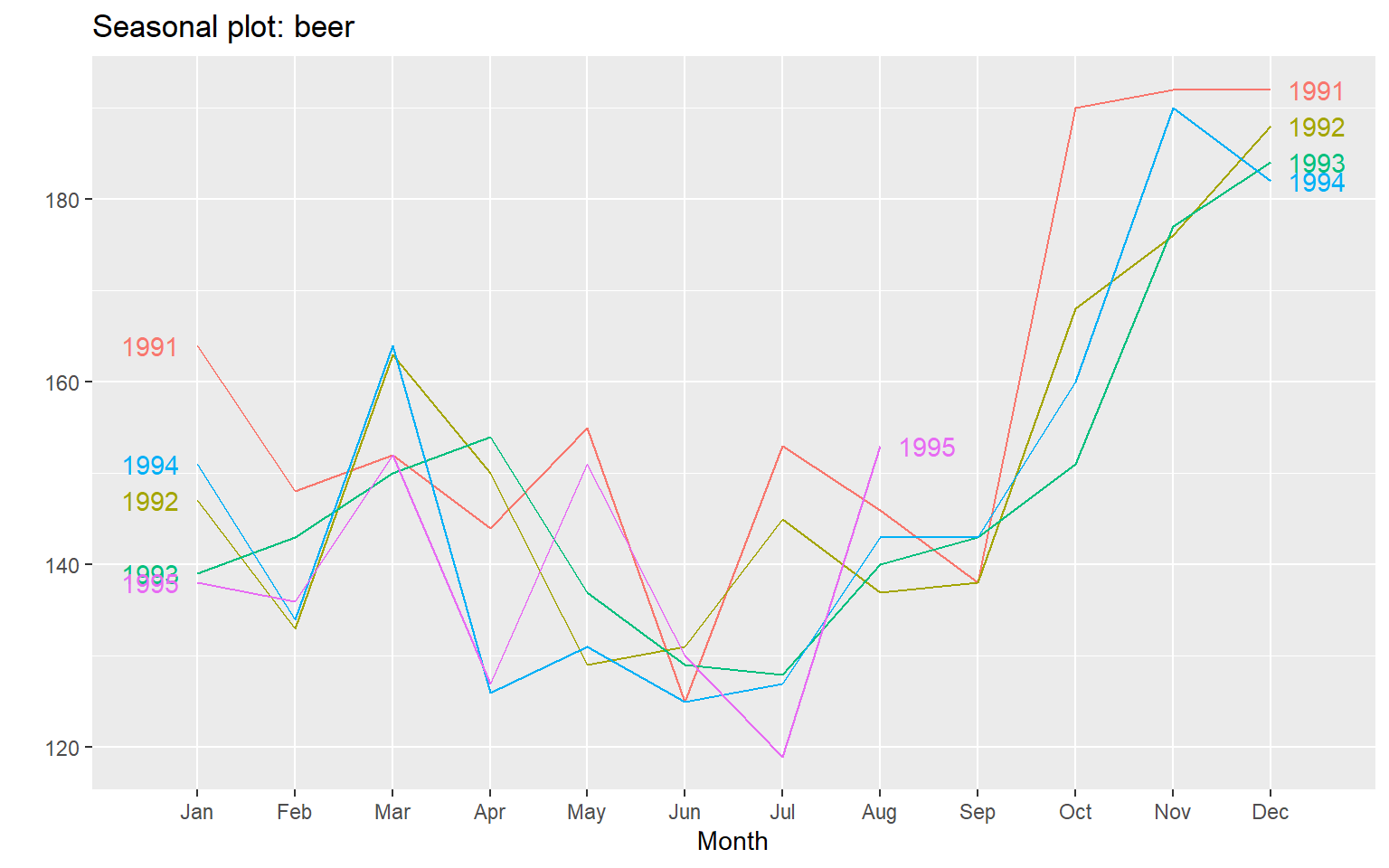

Example 1

Time series plot

Seasonal plot

ggseasonplot(beer, year.labels=TRUE, year.labels.left=TRUE)

ACF

ggAcf(beer)

ggseasonplot(beer, year.labels=TRUE, year.labels.left=TRUE)

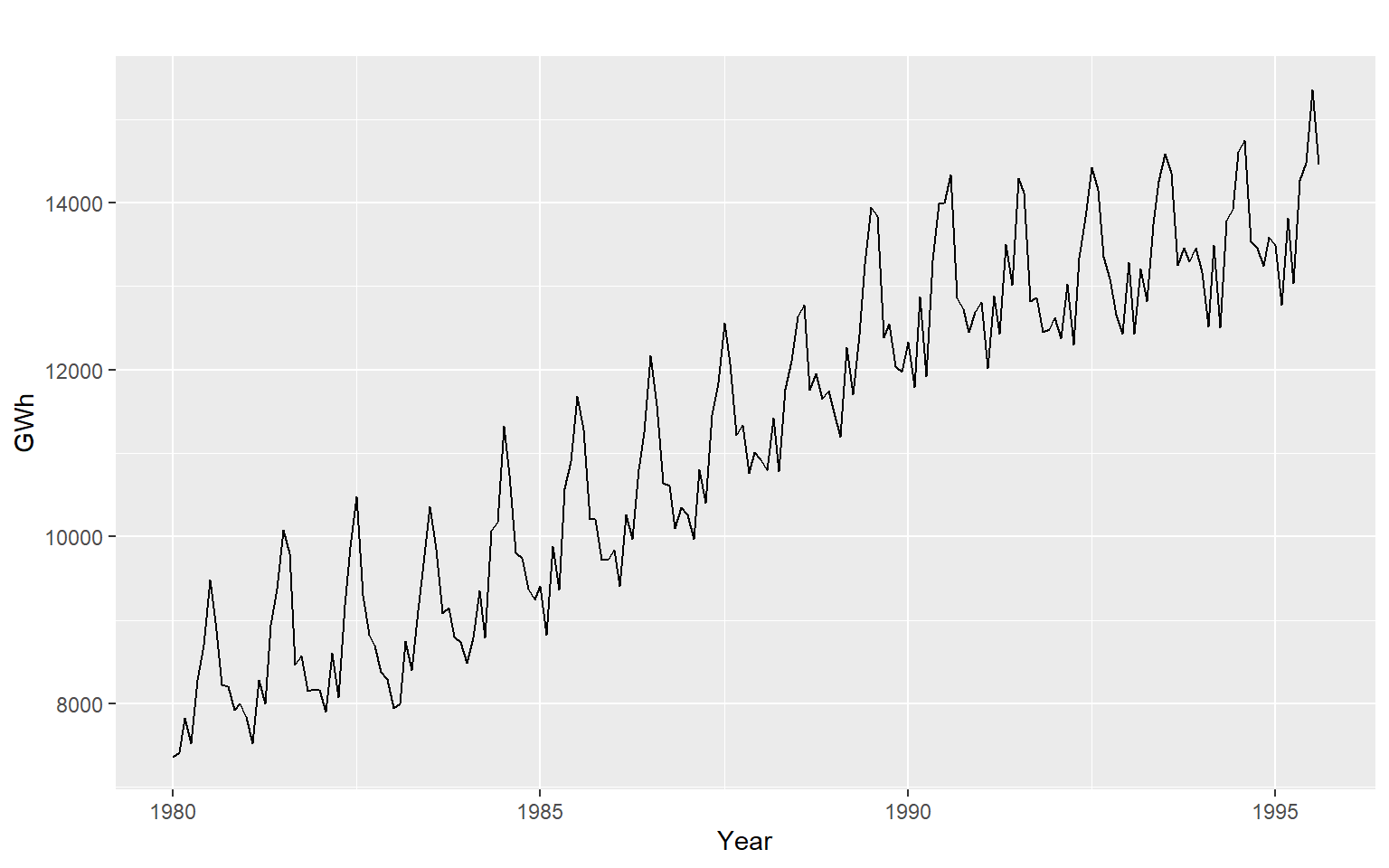

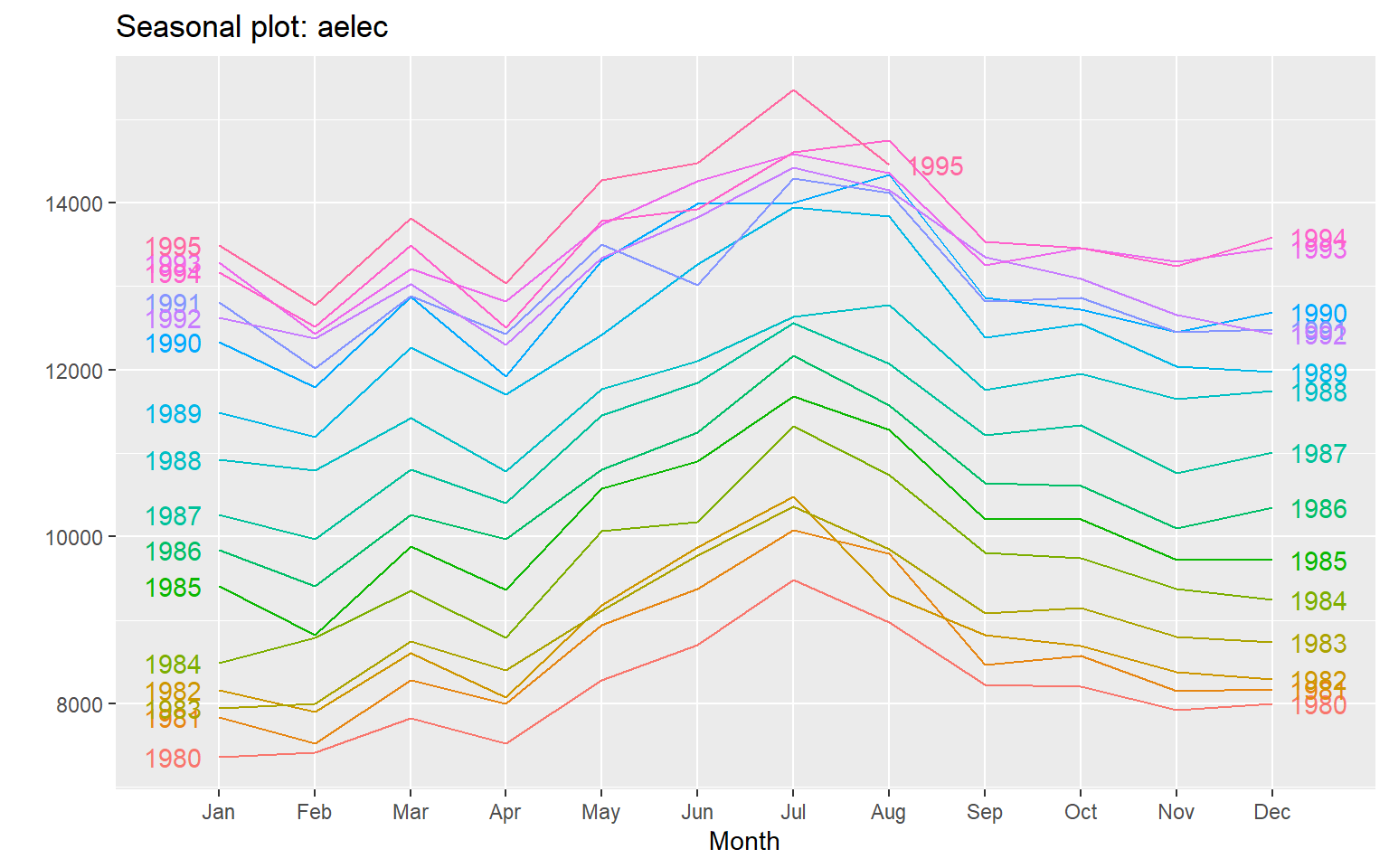

2.15 Example 2

Seasonal plots

ggseasonplot(aelec, year.labels=TRUE, year.labels.left=TRUE)

ggAcf(aelec, lag=48)

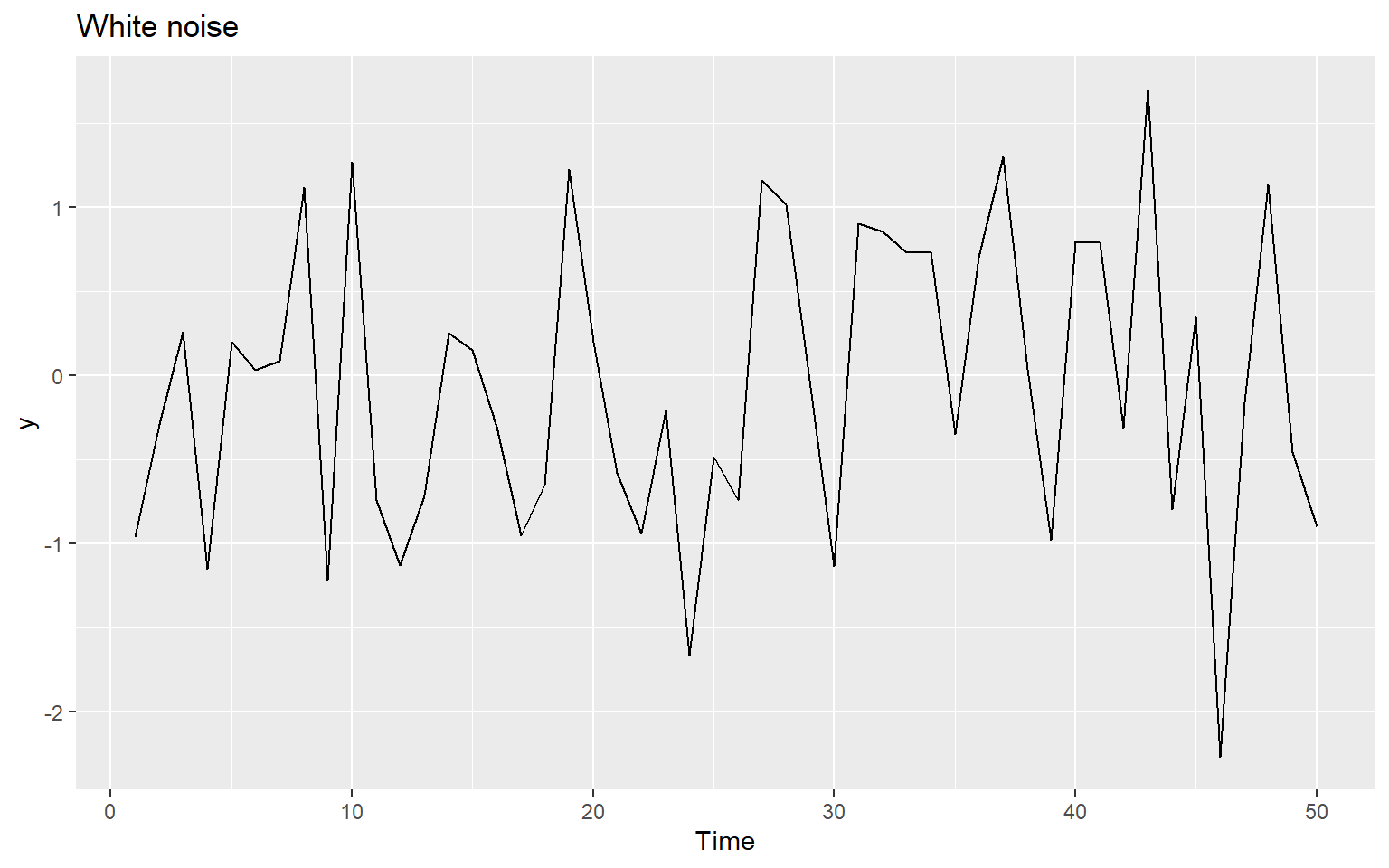

2.16 Example 3

ggAcf(y)

2.17 Exercise

Question 6 at https://otexts.com/fpp2/graphics-exercises.html